Not known Facts About Broker Mortgage Near Me

Wiki Article

A Biased View of Mortgage Brokerage

Table of ContentsThe 3-Minute Rule for Broker Mortgage FeesTop Guidelines Of Broker Mortgage RatesAn Unbiased View of Mortgage BrokerNot known Facts About Broker Mortgage CalculatorWhat Does Mortgage Broker Average Salary Do?An Unbiased View of Broker Mortgage Calculator

The home loan broker's work is to recognize what you're attempting to attain, work out whether you are all set to leap in now and also after that match a lender to that. Before talking about loan providers, they require to gather all the information from you that a financial institution will need.

A significant change to the industry occurring this year is that Home loan Brokers will need to follow "Benefits Task" which means that legally they have to place the customer initially. Interestingly, the financial institutions do not have to abide by this brand-new policy which will certainly profit those clients making use of a Home loan Broker much more.

Unknown Facts About Mortgage Broker Average Salary

It's a mortgage broker's work to help get you prepared. Maybe that your financial savings aren't quite yet where they ought to be, or it might be that your revenue is a little bit questionable or you've been freelance and the banks need more time to examine your scenario. If you're not yet ready, a mortgage broker is there to equip you with the knowledge and recommendations on exactly how to boost your placement for a finance.

The home is your own. Created in partnership with Madeleine Mc, Donald - mortgage broker association.

8 Simple Techniques For Mortgage Broker Association

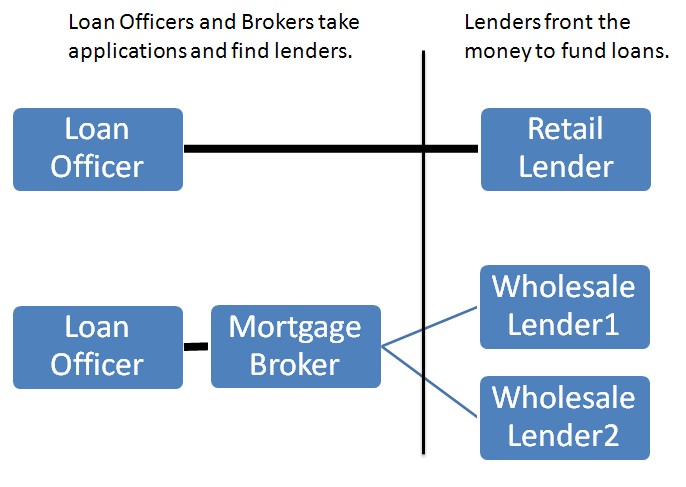

They do this by comparing mortgage products supplied by a range of lenders. A home loan broker acts as the quarterback for your financing, passing the sphere in between you, the borrower, and the loan provider. To be clear, home mortgage brokers do a lot more than aid you obtain a basic home loan on your residence.When you go to the financial institution, the bank can only supply you the items as well as services it has readily available. A financial institution isn't likely to tell you to drop the street to its competitor that supplies a home loan learn this here now item much better suited to your demands. Unlike a financial institution, a home mortgage broker often has partnerships with (usually some loan providers that do not directly deal with the general public), making his possibilities that better of discovering a lender with the very best mortgage for you.

If you're aiming to refinance, access equity, or get a 2nd mortgage, they will require details about your present lendings already in position. useful link As soon as your mortgage broker has a great concept concerning what you're looking for, he can focus on the. In lots of instances, your home mortgage broker may have almost whatever he needs to wage a home loan application at this factor.

Not known Details About Mortgage Brokerage

If you have actually already made a deal on a property and also it's been accepted, your broker will submit your application as a real-time offer. As soon as the broker has a home loan dedication back from the loan provider, he'll go over any type of conditions that need to be satisfied (an appraisal, evidence of income, evidence of down settlement, and so on).Once all the loan provider problems have been met, your broker needs to guarantee lawful instructions are sent out to your lawyer. Your broker must continue to inspect in on you throughout the process to ensure whatever goes efficiently. This, essentially, is just how a home loan application functions. Why utilize a home mortgage broker You may be asking yourself why you ought to utilize a home mortgage broker.

Your broker should be skilled in the home loan products of all these lending institutions. This implies you're much more likely to find the best mortgage item that matches your needs - broker mortgage near me.

Unknown Facts About Broker Mortgage Fees

When you shop on your own for a mortgage, you'll this website require to request a home loan at each loan provider. A broker, on the various other hand, must recognize the lenders like the rear of their hand and also must be able to focus in on the lender that's best for you, saving you time as well as securing your credit history from being reduced by applying at also numerous lending institutions.Make certain to ask your broker how numerous lending institutions he manages, as some brokers have accessibility to even more loan providers than others as well as might do a greater quantity of business than others, which implies you'll likely obtain a much better price. This was a summary of collaborating with a home mortgage broker.

85%Marketed Price (p. a.)2. 21%Contrast Price (p. a.) Base standards of: a $400,000 finance amount, variable, dealt with, principal and also passion (P&I) mortgage with an LVR (loan-to-value) ratio of at the very least 80%. The 'Contrast Home Loans' table allows for computations to made on variables as selected and also input by the individual.

Little Known Questions About Broker Mortgage Fees.

The alternative to making use of a home mortgage broker is for people to do it themselves, which is occasionally referred to as going 'direct'. A 2018 ASIC survey of consumers that had actually taken out a finance in the previous year reported that 56% went direct with a lending institution while 44% experienced a home loan broker.Report this wiki page